Nailing your ICP might be the most important GTM strategy

Our research shows that less than half of B2B marketers say they have their ICP defined and that everyone on the GTM team understands it.

We’ve been having this debate internally lately:

When a new customer wants to work with us to do analyst and advisory work, can they start anywhere, with their most pressing problem?

Or, do they have to start with Pillar 1 - Total Relevant Market?

Of course, if you come to us and say “we want to do a Pipeline Velocity workshop” or “can you help us figure out customer expansion?” we will help however we can. We will meet you where you are.

HOWEVER.

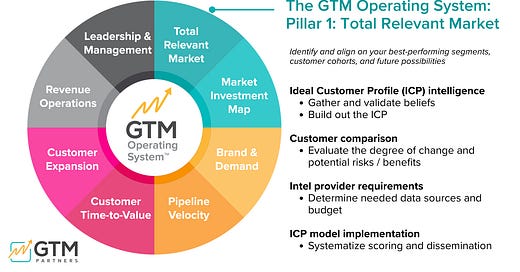

The truth is that understanding your Total Relevant Market (TRM) and Ideal Customer Profile (ICP) is the cornerstone of your entire GTM strategy.

Just as the cornerstone of a building provides stability and support for the entire structure, the foundational concept of identifying your ideal customer is essential for the development and success of any subsequent Go-to-Market ideas or plans.

If you don’t have your ICP nailed, it’s very hard

How is a clearly-defined ICP crucial for GTM success?

An ICP is a detailed description of your perfect customer.

Getting it right can be the difference between growth and stagnation.

Here's why getting it wrong can be detrimental:

Wasted Resources: Without a clear ICP, your marketing and sales teams may be targeting the wrong audience, which means inefficient resource allocation.

Ineffective Messaging: An inaccurate ICP can result in messaging that doesn't resonate with your target audience, leading to missed opportunities and poor conversion rates.

Misalignment: Misalignment between marketing and sales can occur when they have different understandings of the ICP, resulting in confusion and missed opportunities. Add CS and product to the mix, and you have a real problem on your hands.

You might have an ICP problem if . . .

Do any of these resonate?

All teams are not aligned on an ICP definition (this means sales, customer success, marketing, and product can all clearly define and understand the ICP)

Not everyone trusts the ICP. Maybe marketing has developed the ICP in isolation, but sales is having trouble closing those deals. Or maybe when sales closes a deal, customer success is having a hard time making the product suit their needs.

We lack the ability to identify companies that match our ICP. Maybe you know exactly who your ICP is, but you have trouble finding companies that are a good match.

We have not prioritized teams and spend on our best ICP segments. If your best ICP is enterprise companies with global operations who prioritize DEI programs, you need to make sure that everything from advertising to content to sales efforts to customer success is aligned accordingly.

We do not have messaging that speaks clearly to this ICP. If your ICP is midsize, B2B, SaaS companies, and your messaging targets the pains and problems of enterprises or start ups, you won’t have the success you want.

Solving your ICP problem might mean better defining it.

It might mean better communicating it.

It might mean better acting on it.

Not everyone has to start from square one.

The whole GTM team needs to be on the same ICP page

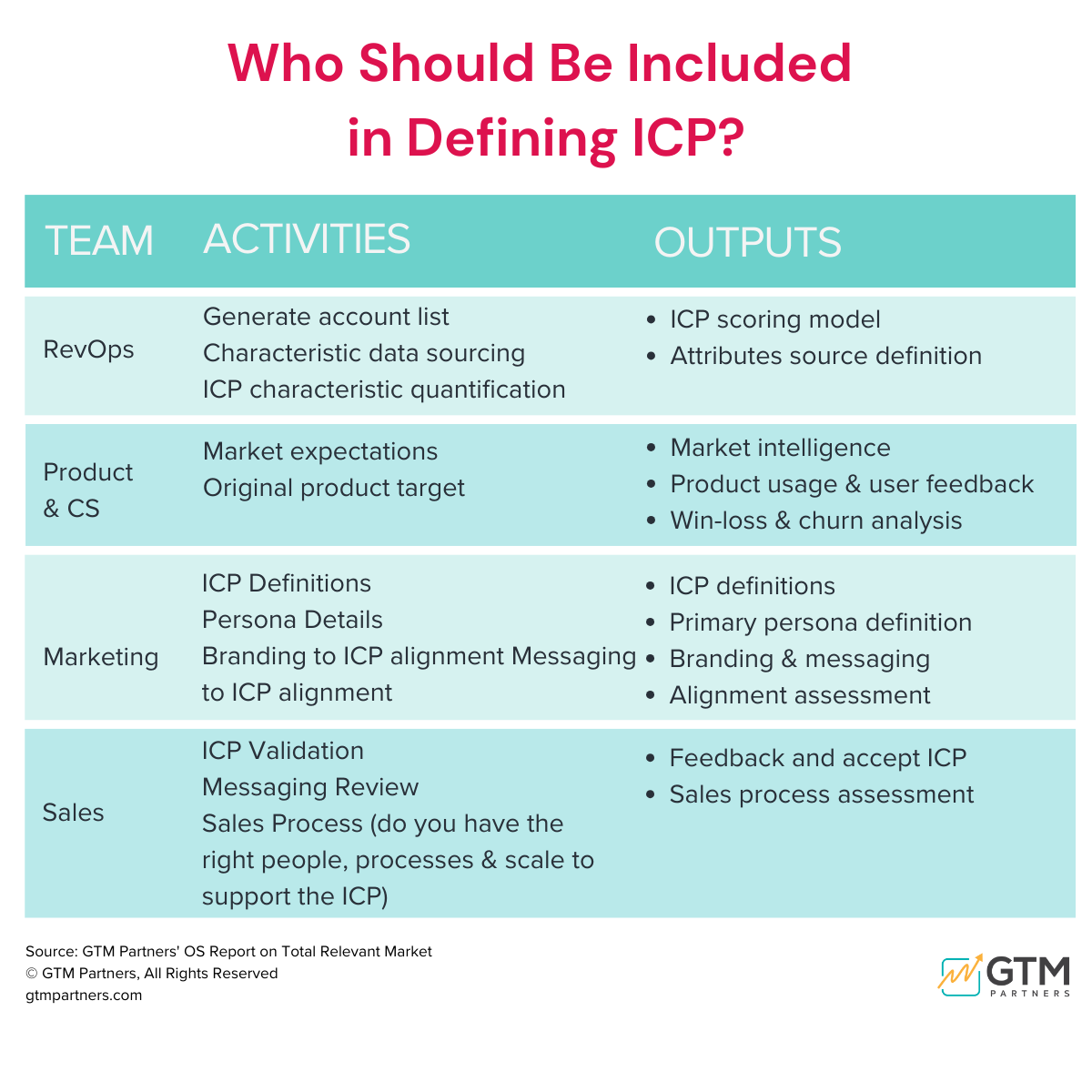

To maximize the impact of your ICP, several key roles within your company need to understand it. Better yet, they need to be involved in creating it.

Marketing Teams: From crafting compelling content to designing targeted ad campaigns, marketing teams depend on the ICP to ensure their efforts are fruitful. The marketing team should also be quickly disqualifying leads outside the ICP unless there is a REALLY good reason to pass them on.

Sales Teams: Sales reps must know who the ideal customer is, so they can identify and convert high-quality leads efficiently. Consider changing compensation to give bigger commissions for best-fit accounts and lower commissions for poor-fit accounts.

Product Teams: The ICP informs product development decisions, helping create solutions that meet customer needs and allowing cuts to features that don’t serve the ICP.

Customer Support: Understanding the ICP ensures support teams can provide tailored assistance and maintain customer satisfaction. It also allows leaders to assign CSMs with more seniority and experience to better fit accounts.

Communicate your ICP across GTM teams

An ICP isn't just a marketing tool; it's a company-wide compass that guides decision-making. GTM executives in marketing and sales, as well as CEOs, should ensure their entire organization understands the ICP.

Here's why:

Alignment: When marketing, sales, product, and customer success and the full executive team understand the ICP, they work in harmony towards common goals, resulting in a more efficient go-to-market strategy. Don’t we all want more harmony at work?

Customer-Centric Approach: Your entire team will be better equipped to align their efforts with what matters most to your ideal customers, from messaging to product features.

Innovation: Your product development team can use the ICP to build features and solutions tailored to the needs of your ideal customers, driving innovation.

How to define and activate your ICP

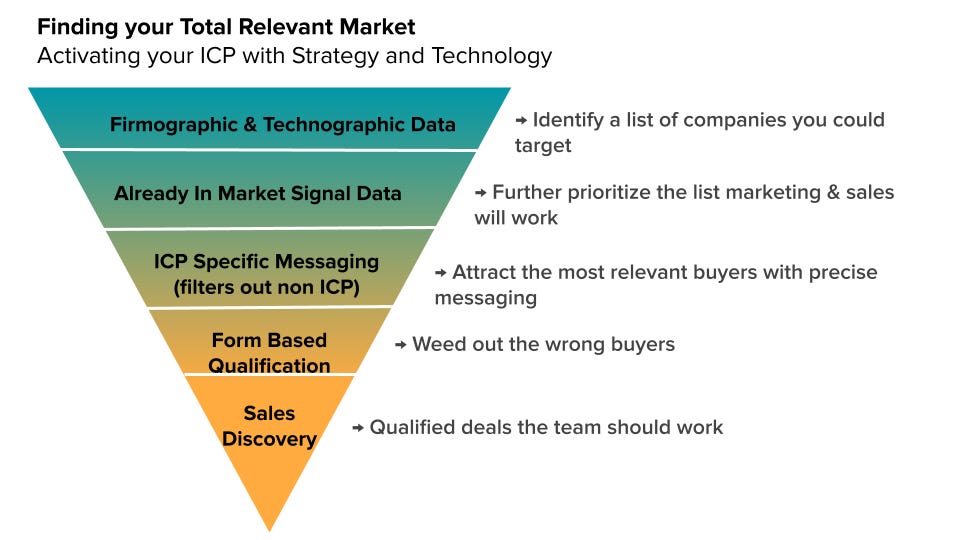

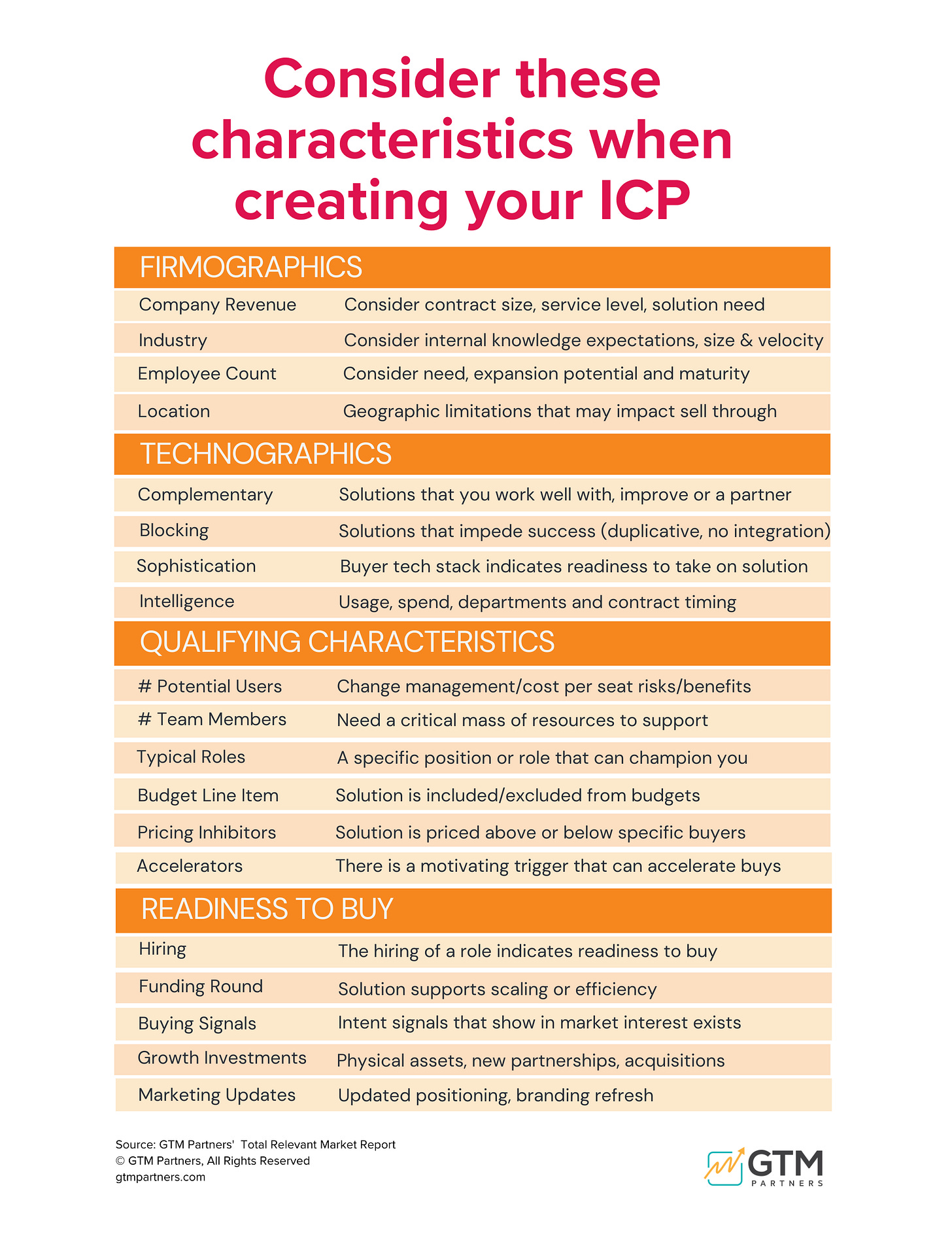

Defining your ICP usually involves analyzing your current customer base and identifying patterns and characteristics that indicate ideal customers who are satisfied, renew, and expand with relative ease.

Data Collection: Gather data on your existing customers, including demographics, firmographics, and behavioral data.

Segmentation and Prioritization: Use data analysis tools to further prioritize the lists that sales and marketing will devote time and effort to.

Tailor Your Messaging: Whether or not you can find your exact, perfect ICP in your lead lists, make sure your messaging will attract the most relevant buyers and turn off those that aren’t.

Form-Based Qualification: Further weed out the wrong buyers with forms.

Sales Discovery: Calls or meetings with trained sales reps should further identify which deals the experienced AEs should devote time and energy to.

Validation: Test your ICP by using it to target new prospects and evaluate the success of your campaigns.

Finding your ICP without data

Not all companies have access to extensive customer data, especially startups or those entering new markets. In such cases, defining your ICP without data is still possible. Here's how:

Market Research: Conduct in-depth market research to understand your industry, competitors, and potential customers.

Buyer Personas: Create buyer personas based on educated assumptions. Start with basic demographics and evolve them as you learn more.

Feedback Loops: Continuously gather feedback from early customers to refine your ICP based on real-world interactions.

ICP should constantly evolve, but requires change management

Your ICP is not static. As your business changes, as your company changes, it’s important to be flexible and revisit your ICP.

Be aware that major changes to ICP require a business strategy rooted in change management.

Things to consider:

Is this a significant departure from where you have been successful in the past?

Will the teams need to change - in staffing, in reporting structures, in skill sets?

How long does it typically take your business to adopt a change, and how would you measure incremental success?

Will this change in focus negatively impact your current customers?

If you have any of the problems with your ICP that we identified above, we’d love to help you figure things out.

Have a great week, and hope to see many of you at our GTM Made Simple road show in Los Angeles on November 3!

Love,

the GTM Partners team

Yes to ICP! It's the most underestimated and overlooked part of the whole process. It's SO CRAZY TO ME that we give this surface attention and then forge ahead- only to find out that EVERYTHING ELSE falls apart completely with the wrong ICP.

It also drives me completely batty that people haven't realized the power of a PODCAST to activate your ICP. We try to abstract and analyze- do anything and everything we can to identify without speaking to the people themselves!

In grade school, we learned the fun saying about what happens when you ASSUME... you make an ass out of u and me! This couldn't be more relevant here.

I worked with a Saas group who *thought* they knew their ICP really well and did something about it. They started interviewing them on a podcast. Their research had said that A, B or C championed the deal toward success each time. Guess what happened? They realized that they were completely wrong about it. By talking to A, B and C types on their pod, they learned about a mysterious department in the organization (we'll call em option D) that were their biggest fans and internal advocates every time!! And when they zeroed in on that ICP the results were freaking mind blowing!